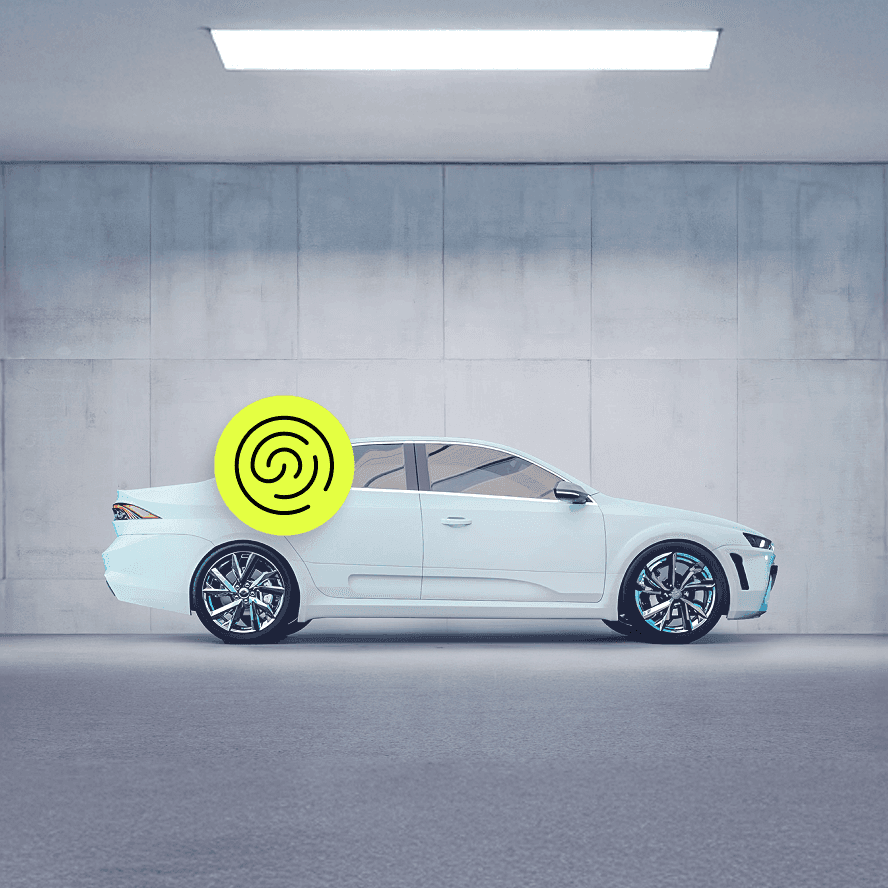

Auto Insurance – Underwriting.

Streamline underwriting with verified photo data.

Insurers quickly verify vehicles at application stage with secure, fraud-proof photo evidence. This reduces manual checks and accelerates policy issuance.

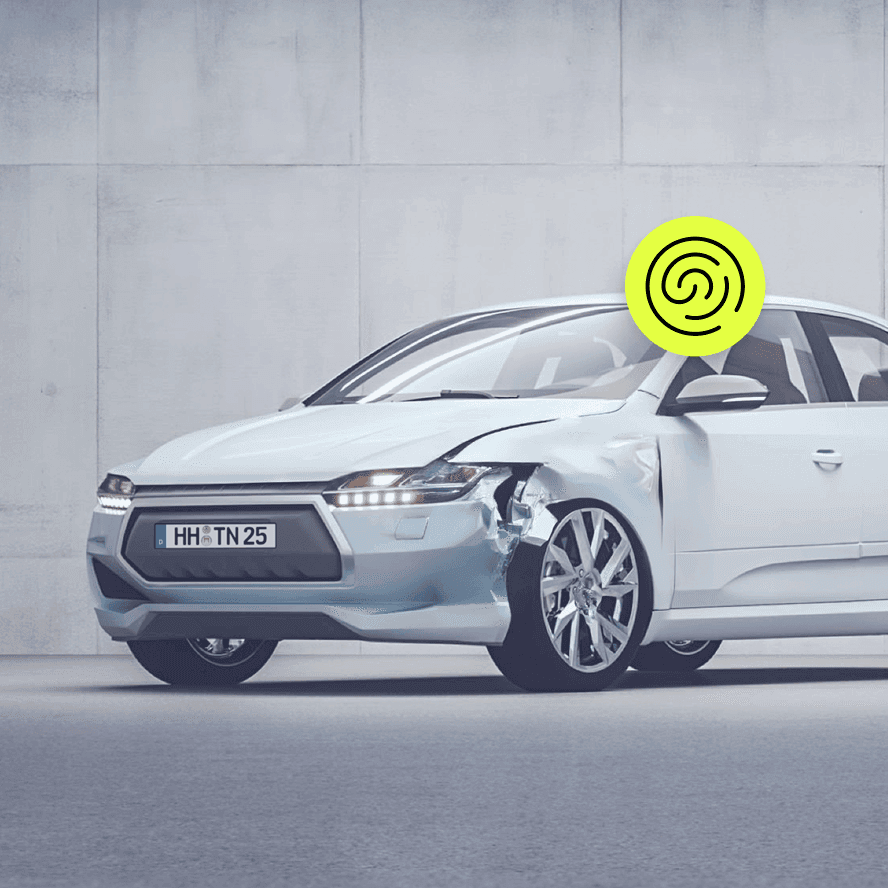

Auto Insurance – Claims Reporting.

Faster, more accurate damage assessment.

Policyholders capture damages instantly with their mobile phone. Insurance claims teams receive authentic, machine-readable data for faster decisions.

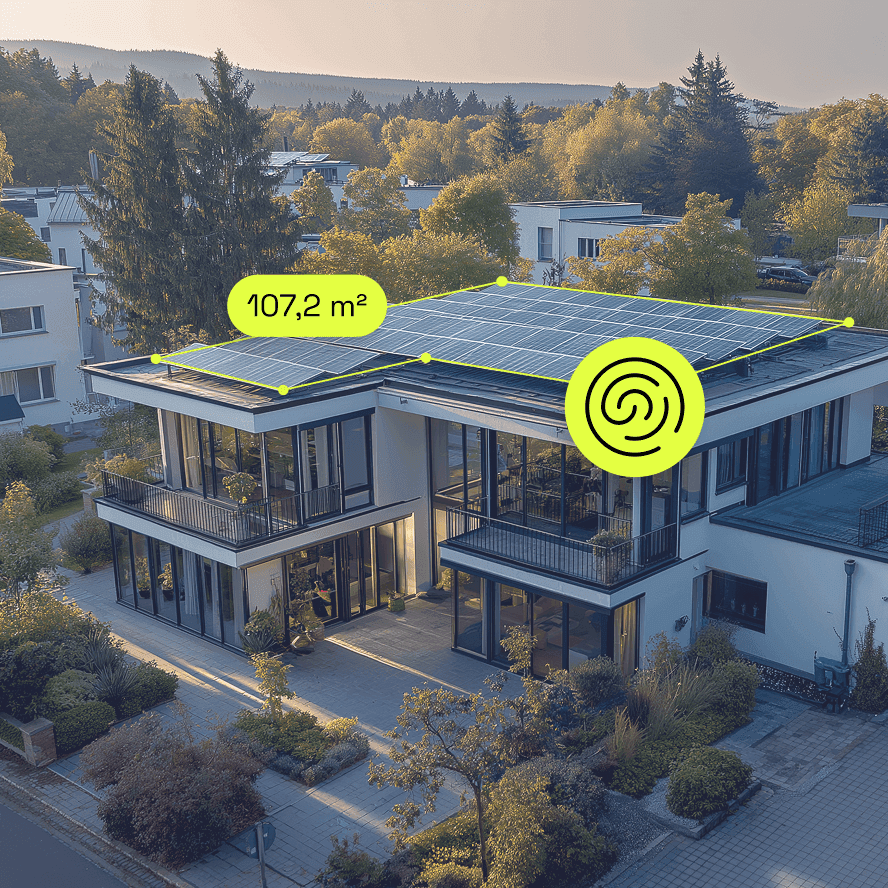

Property Insurance – Underwriting.

Trusted insights for property underwriting.

Insurers collect high-quality photo documentation of buildings and installations (e.g., solar panels) captured by policyholders with their mobile phone to assess risks upfront and simplify applications.

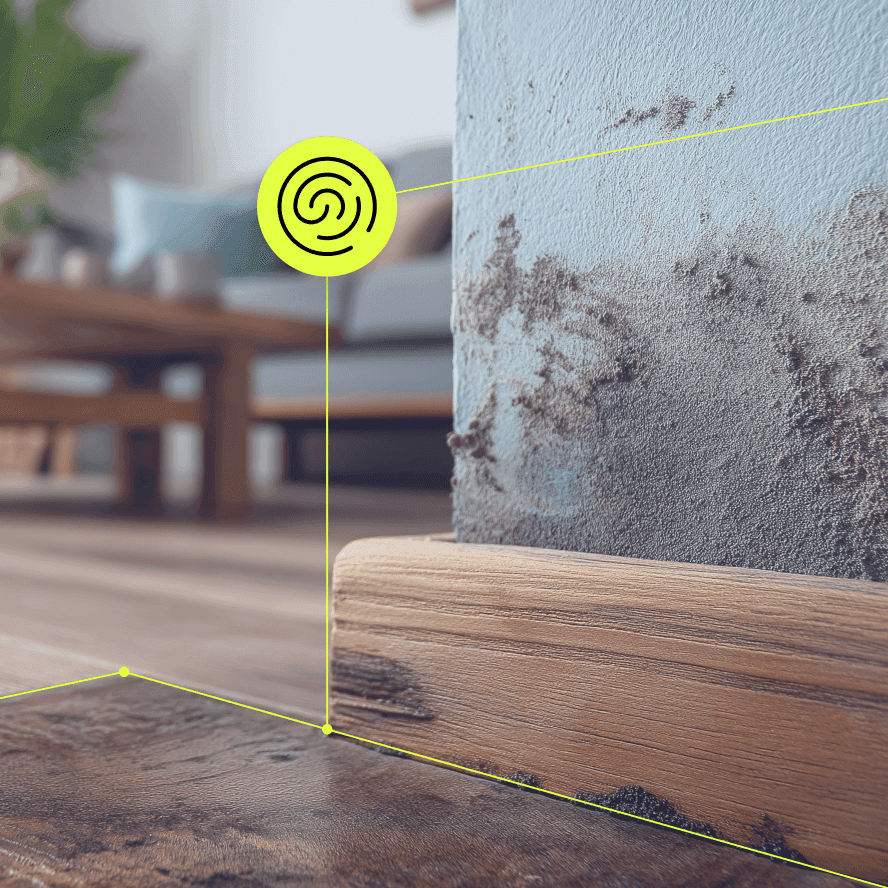

Property Insurance – Claims Reporting.

Efficient documentation of property damage.

Policyholders provide verified photos of incidents like water damage. Insurers get reliable photos and documentation for fast and accurate claims handling.

Household Insurance – Underwriting.

Simple, secure onboarding for valuable items.

From furniture to luxury goods, policyholders can document belongings with fraud-proof images they capture with their mobile phones. Underwriting becomes faster and more reliable.

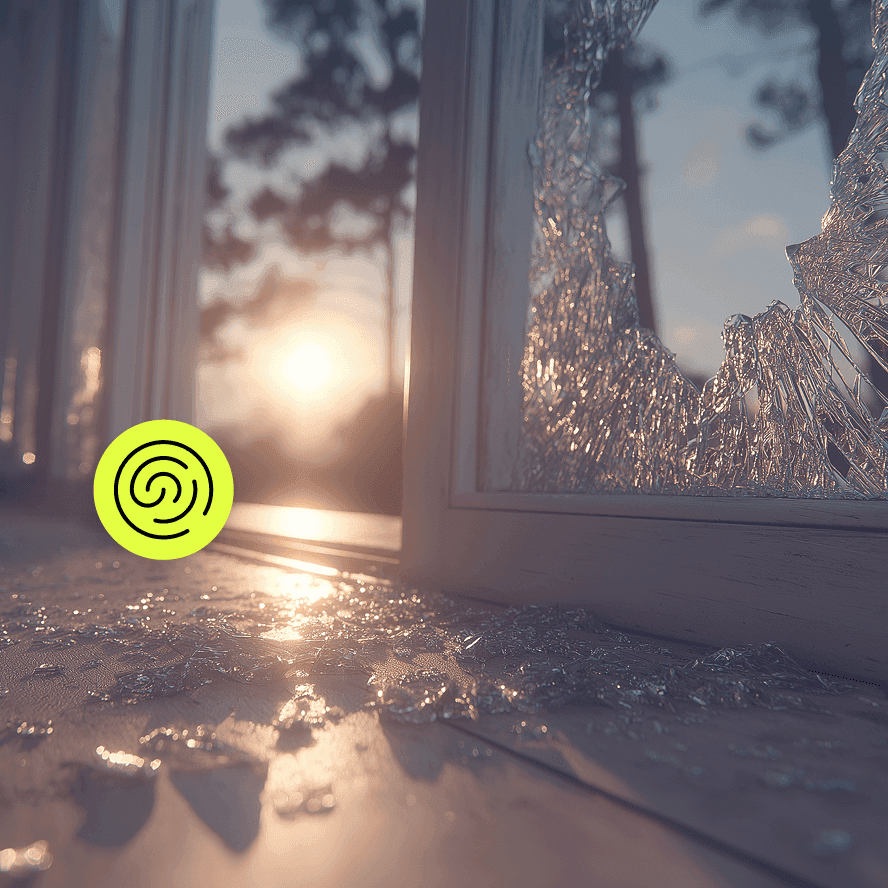

Household Insurance – Theft Reporting.

Clear evidence for loss events.

Policyholders submit verified images (e.g., broken glass) to support theft claims and photos of the insured objects previously recorded during underwriting. This speeds up the claims settlement process.

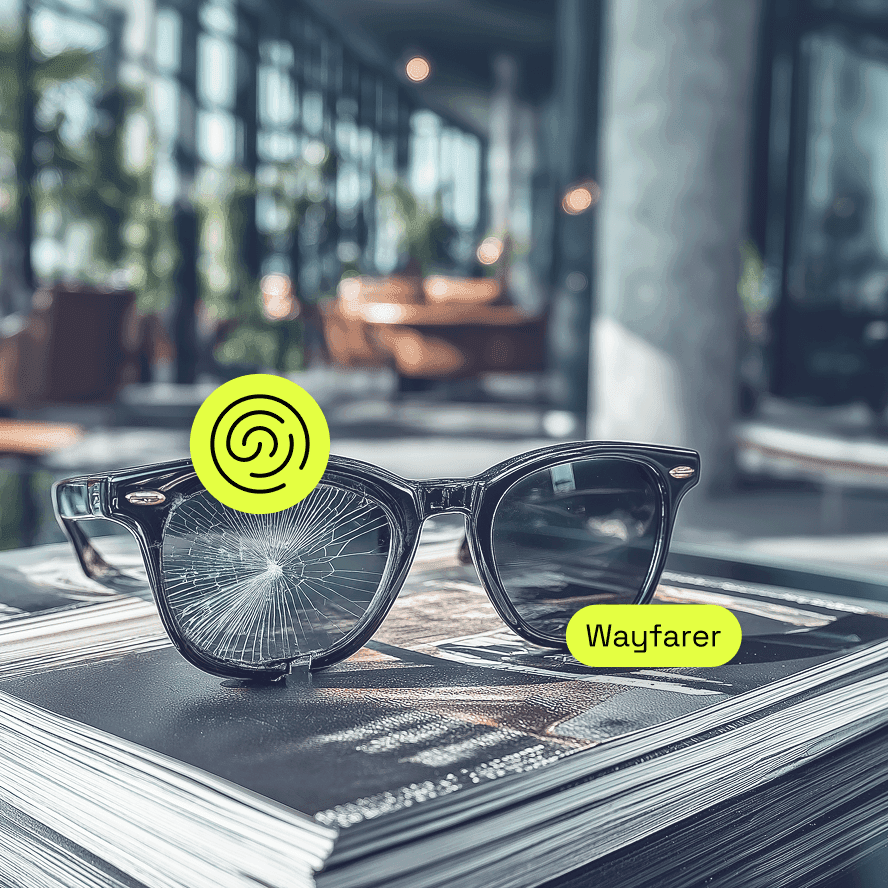

Liability Insurance.

Transparent documentation of liability cases.

Evidence of incidents such as broken glasses are reported with photo capture by policyholders. Insurers instantly receive structured, authentic data to evaluate claims.

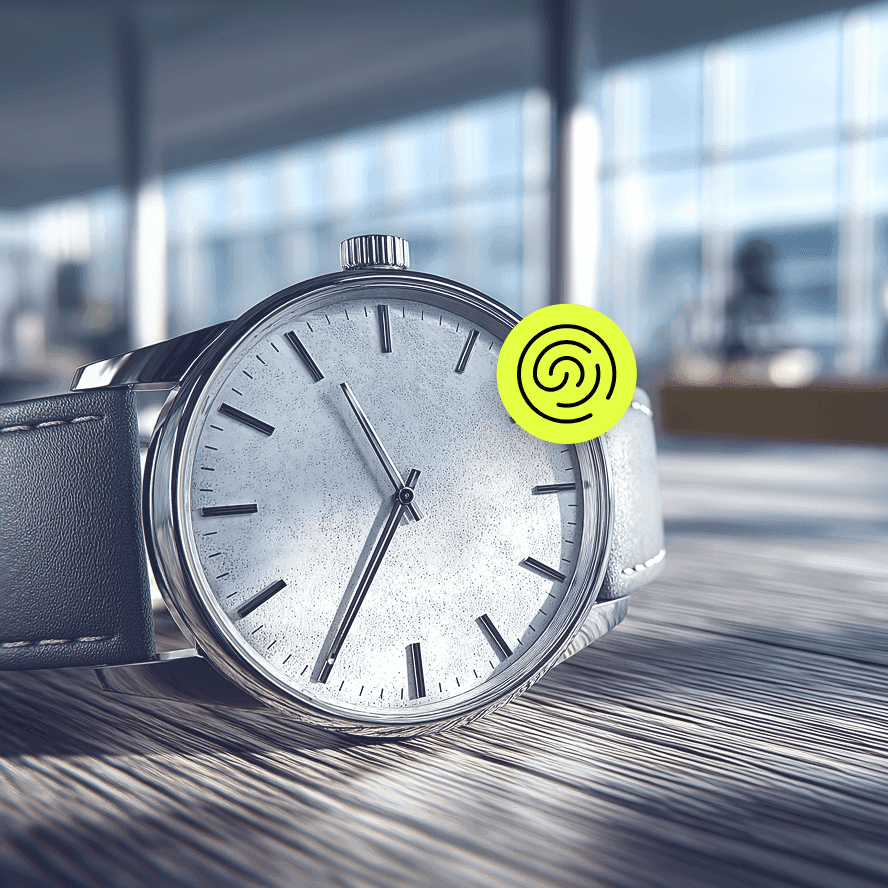

Embedded Insurance – Claims Reporting.

Seamless claims in partner ecosystems.

From damaged parcels to consumer goods, customers report claims directly via trusted photo evidence. Claims are processed faster and with less friction.